Japan’s top government spokesperson condemned China’s ban on exports of dual-use items as “absolutely unacceptable and deeply regrettable” on Wednesday, marking a significant escalation in the diplomatic dispute between Asia’s two largest economies.

Dual-use items are defined as goods, software, or technologies possessing both civilian and military utility.

A key example is certain rare earth elements, which are indispensable components in the manufacture of advanced technologies like drones and microchips.

Due to their potential for military application, the trade and export of these dual-use items are often subject to strict regulatory controls and international scrutiny.

Diplomatic tensions boil over

Japanese Prime Minister Sanae Takaichi sparked a diplomatic incident with Beijing after she stated that a Chinese assault on Taiwan could constitute an “existential threat” to Japan.

The comment reignited tensions over the status of Taiwan, a self-governed island that China claims as its sovereign territory.

The statement by Takaichi implied that Japan might be compelled to intervene militarily to protect its own security interests if China were to invade, potentially drawing Tokyo into a conflict.

Beijing vehemently opposes any foreign interference in what it considers a purely domestic matter, escalating the geopolitical risk in the region.

The escalating diplomatic dispute saw Beijing demand a retraction of certain remarks, a demand that Japan’s Prime Minister has refused to meet.

This non-compliance has triggered a chain of retaliatory measures from China.

The most recent and significant of these countermeasures, announced on Tuesday, is a prohibition on the export of dual-use items—goods with both civilian and military applications—specifically when intended for military use.

This step is a clear escalation, leveraging economic tools to exert pressure following the sustained refusal to retract the controversial statements.

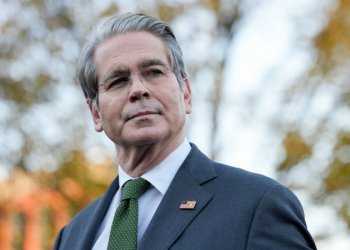

“A measure such as this, targeting only our country, differs significantly from international practice, is absolutely unacceptable and deeply regrettable,” Japan’s Chief Cabinet Secretary Minoru Kihara told a daily press conference on Wednesday, according to a Reuters report.

He, however, refused to discuss the potential effects on Japanese industry, stating that the specific items to be targeted were still unknown.

Despite a global rally that saw US and European benchmarks reach record highs, the market reaction to the news in Japan was somewhat subdued.

Japanese shares, in contrast, were lower on Wednesday. The broader Topix index of equities fell by 0.55%, with mining shares experiencing the steepest decline, dropping 3.2%.

Ban on rare earth minerals?

The Chinese Communist Party-owned newspaper, China Daily, reported on Tuesday that Beijing is contemplating a wider restriction on rare earth exports to Japan by tightening the license review process.

Analysts suggested that such a development could profoundly impact the manufacturing centre, particularly its crucial automotive industry.

Despite Japan’s efforts to diversify its rare earth supply since China restricted exports in 2010, the country still sources approximately 60% of its total rare earth imports from China.

A three-month Chinese restriction on rare earth exports, similar to the 2010 event, could result in a 660 billion yen ($4.21 billion) loss for Japanese businesses and reduce Japan’s annual gross domestic product by 0.11%.

This assessment was provided by Nomura Research Institute economist Takahide Kiuchi in a note published on Wednesday.

A year-long ban is estimated to decrease China’s GDP by 0.43%.

Despite this, China Customs data, though subject to some delay, has not yet indicated a drop in rare earth exports to Japan.

In fact, exports for November—the most recent month for which data is available—increased by 35% to 305 metric tons, marking the highest volume for the past year.

The post Japan condemns “unacceptable” Chinese ban as rare earth worries rise appeared first on Invezz