Bank of America (NYSE: BAC stock) delivered a solid beat on earnings and revenue for the fourth quarter, reporting diluted earnings of $0.98 per share, surpassing the consensus of $0.95-$0.98.

The bank posted a revenue of $28.37 billion, above expectations of $27.3-$27.8 billion. The quarter showcased strength in trading and net interest income, alongside resilient consumer spending.

Yet in early trading, BAC stock fell nearly 4%, signaling that Wall Street has already moved past the headline numbers to focus on deeper concerns.

The investors are treading with caution amid weakening investment banking, Federal Reserve headwinds, and a mounting regulatory threat that could reshape the bank’s credit-card business.

BAC stock: Where the strength came from

Net interest income: the money banks earn from the gap between what they charge borrowers and what they pay depositors, grew 10% year-over-year to $15.8 billion, beating analyst expectations.

This resilience surprised some because markets had been pricing in greater pressure from potential Federal Reserve rate cuts in 2026.

The bank benefited from fixed-rate assets rolling off the balance sheet at higher yields and continued loan and deposit growth.

Beyond lending, Bank of America’s markets division shone.

Equity trading income surged 23% year-over-year to an all-time Q4 high, powered by the volatility markets delivered in January.

Sales and trading revenue overall grew 10%, marking the 15th consecutive quarter of year-over-year growth.

This proved that Wall Street was indeed bustling in Q4, capitalizing on choppy conditions and active capital markets flows.

Management guided to 5-7% net interest income growth in 2026, supported by roughly $10-15 billion in fixed-rate assets repricing at higher yields.

If that outlook holds, it would keep the bank’s earnings on a solid growth trajectory despite the uncertain rate environment.

Why analysts remain cautious

Investment banking performance, however, was a letdown.

IB fees in global banking were nearly flat, while equity underwriting plunged around 20%.

Analysts worry this weakness signals that the dealmaking momentum could cool in 2026 as tariff uncertainty and political shifts dampen M&A activity.

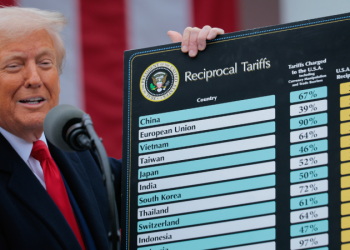

The second concern is more immediate and politically charged: President Trump’s proposed 10% cap on credit card interest rates, set to take effect January 20.

Average credit card rates currently sit at 21%, meaning a 10% cap would cut a major profit driver roughly in half.

JPMorgan and Bank of America executives have warned the cap would devastate credit availability, cutting off lending to roughly 82-88% of subprime borrowers.

While the industry is lobbying hard for changes, the proposal creates uncertainty that could weigh on BAC stock until there is regulatory clarity.

Finally, there’s the Fed question. Management’s 5-7% NII growth guidance assumes a relatively benign rate environment.

If the Fed cuts three times in 2026, a scenario analysts debate, that guidance could face downward pressure, and earnings revisions could follow.

Bank of America’s quarter confirms core business resilience.

But investors’ focus will remain fixed on three risks: forward net interest income credibility if rates fall, investment banking sustainability, and whether regulators will impose the credit card rate cap.

The post Bank of America Q4 beat estimates, but here’s why BAC stock may stay in red appeared first on Invezz