Copper prices crashed from their record high perch last week as Chinese bulls retreated from a turbulent commodity market.

The cross-commodity selloff also pulled down copper prices, which are currently over 10% lower than the peak reached last week.

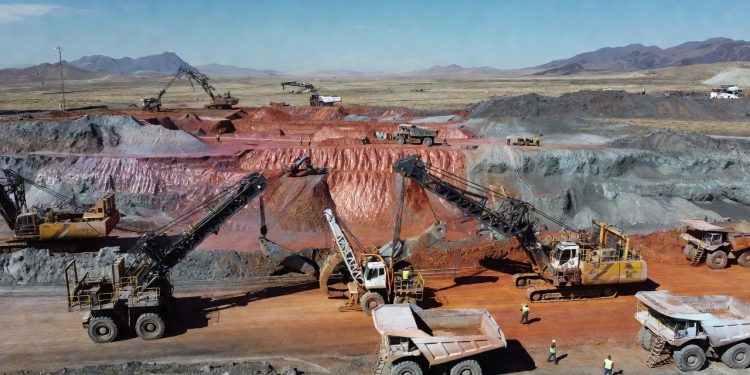

Prices had topped a record $14,500 per ton on the London Metal Exchange last week, primarily driven by speculation and mine disruptions.

However, prices have recovered somewhat, and were 1% higher on Tuesday as investors resorted to buying from lower levels.

At the time of writing, the three-month contract on LME was at $13,099 per ton, up 1.3% from the previous close.

Fundamentals remain strong despite volatility

“Its fundamentals still look supportive, driven by tight mine supply, constrained growth in key producers, and strong structural demand linked to electrification and AI-related data‑centre build-outs,” Ewa Manthey, commodities strategist at ING Group, said in a note.

The recent price surge has also kept many industrial users on the sidelines, but lower prices should now draw physical buyers back into the market, helping to stabilise demand.

While copper is currently experiencing near-term volatility due to broader macroeconomic uncertainty—such as interest rate fears or global economic slowdown concerns—the fundamental bullish case for the metal remains strong.

The underlying narrative driving copper demand is anchored by the global energy transition, which requires vast amounts of the metal for electrification, renewable energy infrastructure, and electric vehicles.

Supply constraints, coupled with this secular demand growth, suggest that any current price weakness is temporary.

Investors should view this dip not as a change in the long-term outlook but as a tactical buying opportunity.

Once macro headwinds subside and market sentiment improves, this strong structural demand is expected to reassert itself, ultimately leading to renewed upward momentum in copper prices.

Secular demand growth: energy transition and AI

“Even though (Thursday’s) sharp rise in the price of copper was probably a speculative exaggeration and has since been corrected, medium-term factors continue to point to a structural increase in the price of copper,” Volkmar Baur, FX analyst at Commerzbank AG, said.

As part of its forthcoming package of measures against Moscow, the European Union is currently contemplating sanctions.

These proposed sanctions would include a ban on importing several Russian platinum-group metals and copper.

Later this month, a proposal covering copper, platinum, rhodium, and iridium could be adopted, provided it receives unanimous approval from all member states.

Russia’s largest miner, MMC Norilsk Nickel, would be the primary target of these measures.

Until now, the company has avoided restrictions because of its critical role in global supply chains.

Sanctions and anticipated market deficit

“The potential ban comes at a time when markets for these metals are already tight,” Manthey added.

Copper’s mine supply is constrained, while platinum is also expected to remain in deficit. This means any loss of Russian material would further tighten availability.

Despite the International Copper Study Group’s report last week predicting a copper surplus in 2025 (covering January through November), expectations are growing that this trend will reverse, perhaps permanently, starting in 2026.

The copper market is now widely anticipated to enter a deficit as early as 2026, a structural imbalance that is likely to persist for several years.

“On the one hand, this is driven by continuing growth in demand. Both the energy transition and artificial intelligence are driving up demand for copper,” Commerzbank’s Baur said.

Global demand is projected to increase from roughly 26 million tons currently to 36 million tons over the next decade, a rise primarily driven by the ongoing energy transition, according to BNEF’s research unit.

Conversely, the supply remains constrained.

The rising demand is not being met due to a scarcity of new mining initiatives, coupled with the challenge of diminishing copper concentration in ores at operational mines.

The post Copper prices crash 10% from peak, but fundamentals point to long-term rebound appeared first on Invezz